SWIFT Code (BIC)

SWIFT code, or Bank Identifier Code (BIC), is one of the most pertinent parts of the SWIFT transfer instructions you need to make your international wire transfer right.

Check & validate your SWIFT BIC

HedgeFlows offers automatic SWIFT (BIC) validation and bank look-up when you set up beneficiary details on our platform. If you were given other beneficiary bank details, it is always helpful to check them against the details we confirm based on the validated SWIFT code. You can similarly check whether the IBAN number of your recipient is in valid format:

Verify which bank a SWIFT/BIC code belongs to

Validate your IBAN number

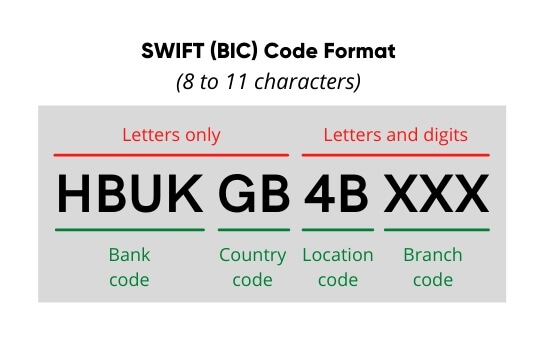

What does SWIFT/BIC usually look like?

Valid SWIFT codes consist of 8 to 11 characters, uniquely identifying the beneficiary bank where the funds need to be transferred. The below picture explains the structure of a typical SWIFT code, using HSBC bank in the UK as an example:

Are SWIFT (BIC) code and IBAN the same thing?

No, the SWIFT (BIC) code belongs to a specific bank and helps identify the recipient bank when making international transfers. The IBAN number belongs to a specific recipient and is an International Bank Account Number in a specific format in a given country.

What does the SWIFT (BIC) checker do?

SWIFT (BIC) Validation helps you check whether your code is valid and confirms the bank's name and location country. It is essential to check these details to ensure you are sending funds to the right country.

What does the IBAN validation do?

IBAN Validation can confirm that the format and structure of the IBAN (account number) are valid. It does not confirm if the account is open or that it belongs to a specific recipient. The latter can be done using Confirmation of Payee checks in the UK and, soon (expected in 2025), across Europe.

What else should I check when sending funds overseas?

Where possible, use tools such as Confirmation of Payee or International Bank Account Validation tools to avoid human errors and Authorised push payment fraud. Modern payment automation systems such as HedgeFlows can help perform these checks seamlessly as an integral part of your payment processes.