Businesses that trade internationally often must plan to protect their cashflows and profit margins from currency swings in coming months and quarters. For many experienced finance managers and directors, this starts with planning their budget rates for upcoming periods.

Budget FX rates

So-called "budget rates" are an essential internal tool that helps forecast future margins and cashflow needs in the presence of foreign currencies and coordinate between commercial and finance teams.

Failure to have realistic budget rates can result in uncompetitive pricing of one’s products or services. It can also erode your profit margin and result in losses in the worst cases.

Forecasting exchange rates is an ungrateful business, so most finance teams rely on forecasts from their banks or financial providers. Or some companies will cushion the current market rate to give them room for error.

Unfortunately, either approach is close in its robustness to flipping a coin - actual exchange rates in coming months or quarters will have a 50/50 chance of being higher or lower than these budget rates, with the difference sometimes being big enough to wipe out the company's profit margins.

The best practice for managing budget rates is to fix effective exchange rates by securing FX forward contracts for future dates that are close to your initial budget rates and the amounts required. The easiest way to achieve that is to actually set your budget rates as you secure future exchange contracts for them, eliminating the time gap when market rates can move.

Certainty of forecasted transactions

Budget rates are beneficial for businesses that don’t know their future cashflows for sure - because sales or purchase orders in foreign currencies have not been invoiced yet or, in some cases, specific commercial transactions have not yet taken place.

This, unfortunately, creates additional challenges for finance teams. They need help accurately predicting the amounts and timings of their future foreign cashflows. Forecasting demand and supply can be affected by numerous factors, and that uncertainty increases as you try to predict further into the future.

To avoid hedging too much, it is common only to hedge a portion of expected future cash flows in foreign currencies - the portion you can estimate a high probability of being required in a given period.

For example, if you are confident that at least 50% of your orders will need to be paid in foreign currency next quarter - it is an accepted practice to hedge such an amount. This is called the minimum hedge ratio.

Hedging too much has downsides, too. You may overestimate your needs and have too many foreign exchange contracts outstanding, which may cost money to cancel. Fixing exchange rates too soon in advance also limits one's flexibility - you may be locking in the rate that may prove unattractive and prevent you from benefiting from better rates. Here the so-called maximum hedge ratio is used to guide your finance team. The maximum hedge ratio is how much you should hedge if the effective exchange rates are at their recent best and work well for your profit margins.

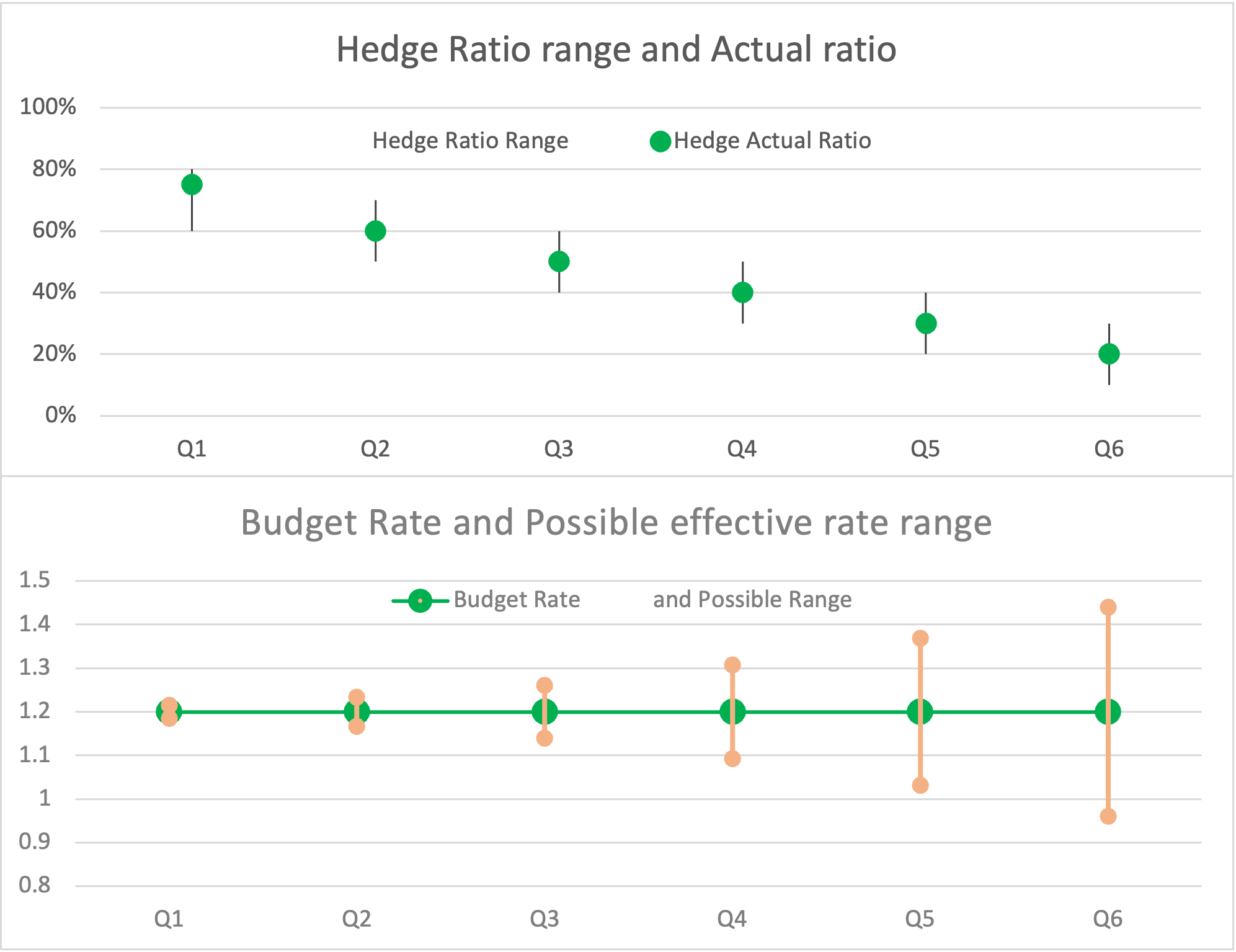

Hedge Ratios over periods

Ensuring your hedges stay within the planned minimum and maximum hedge ratios can help increase the certainty of effective rates and plan your business needs with more realistic numbers.

Because recommended hedge ratios are usually lower for more distant future periods and because exchange rates have more time to move until then - the uncertainty about the exchange rates is the greatest for them. As you progress in time close to the current period, hedge ratios increase. As a result, your most immediate exchange needs will have the greatest certainty of guaranteed rates. As you can see on the graph below, this results in the most immediate periods having the highest confidence of effective exchange rates achieved:

Layering FX hedging and Hedge Ratios

Implementing and following robust hedge ratios allows flexible budget rates to evolve from one period to the next. As time passes, business needs for each period become more certain, and the hedge ratios schedule dictates topping up the hedge amount. This creates a new layer of hedge for each period, and because the new hedge is done at different rates, a blended effective FX rate is fixed for each period as a result. HedgeFlows toolkit helps automate the entire process, streamlining the process of hedging, tracking effective rates and predicting potential effective rates for future periods.

Contact our sales team if you want to learn more at hello@hedgeflows.com or our online chat.

Tags:

Post by Alex Axentiev

Apr 5, 2023 8:30:09 AM

Apr 5, 2023 8:30:09 AM

Co-founder of HedgeFlows and expert in financial risk management and financial markets.