THE BAMBOO DREAM

They are the powerhouse that drives UK plc forward - spreading innovation, equal opportunity and prosperity.

Why should SMEs aspire to grow in the same way bamboo does? Well, bamboo has certain qualities that make it unique in the tree world:

- Its Speed. Bamboo is known for its incredibly fast growth rate, which can be up to 35 inches in a single day. Ideally, you’d want your business to experience rapid growth.

- Its Flexibility. Bamboo is a flexible and adaptable material, which can be used for a variety of purposes. In the same way, successful businesses are often flexible and able to pivot quickly in response to changes in the market.

- Its Strength and Resilience. Bamboo has a higher tensile strength than steel, which means it can withstand a lot of stress before breaking. Similarly, successful businesses need to be strong and resilient in order to weather challenges and setbacks.

- Its Rootedness. Bamboo is known for its deep and extensive root system, which helps to anchor it in place and keep it stable. Similarly, businesses that have strong roots in their values, mission, culture and operations are more likely to succeed in the long term.

COMPETING AGAINST BAOBABS

The importance of SMEs to the UK and other countries' economies has been written about extensively. In the UK, SMEs make up more than half of corporate turnover and more than 60% of employment.

All businesses must balance risk with potential reward whenever making a strategic decision about their business operations. But this balance is particularly important for smaller businesses as they have more limited resources. SMEs are constantly competing against baobabs of the tree world; the big and established corporations.

BREAKING THE POT

So, what can SMEs do to break their pot and so grow beyond the restraints of their pot?

Although there is no instant silver bullet that can close the gap immediately, there are a couple of key themes that emerge.

- The first is the use of technology.

The increased accessibility of technology to enhance productivity has meant that solutions are slowly making their way to SMEs. Unfortunately, often these are either enterprise solutions with enterprise price tags. Or cut price solutions from the enterprise world that fail to recognise the inherent differences between large and small companies.

Many SME employees need to multi-task and perform different roles as part of their responsibilities. So, they need easy to use, intuitive and cost effective technology solutions that don’t require specialist training and that can be implemented simply and quickly with a minimum of disruption to existing and adjacent business processes.

- The second theme related to improving the productivity of smaller companies involves strengthening the participation of SMEs in the global value chain.

This just a fancy way of saying “getting involved in international trade”, or to keep it in line with our theme “putting down roots in new soil”.

SMES WANT TO TRADE BUT ARE not DOING IT ENOUGH

The new relationship with the EU and the subsequent pandemic have both left their marks on the UK's SME ecosystem. According to The SME Finance Monitor, 61% of SMEs undertaking any international trade reported a negative impact from the new trading arrangements with the European Union. Due to the Covid pandemic, the number of businesses reporting losses has doubled to 20%.

In a recent survey of UK SME business owners and decision makers, undertaken by HedgeFlows, we found that 69% believe their business would substantially benefit from expanding internationally. However, it’s estimated that only about 10% of SMEs actually take part in international trade. What is stopping them? One of the main reasons is trading costs.

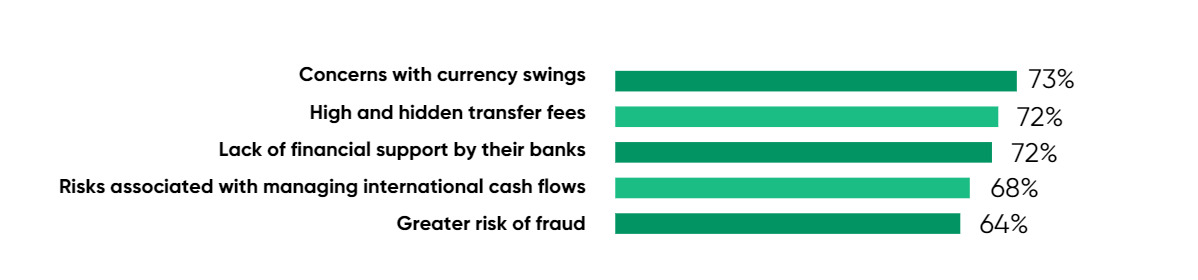

In our research, 70% of company owners said they will not expand beyond the UK because trading costs remain too high. When asked about the specific areas concerning them they mentioned: currency swings (73%), high and hidden transfer fees (72%), the lack of financial support by their banks (72%), the risks associated with managing international cash flows (68%) as well as a greater risk of fraud (64%).

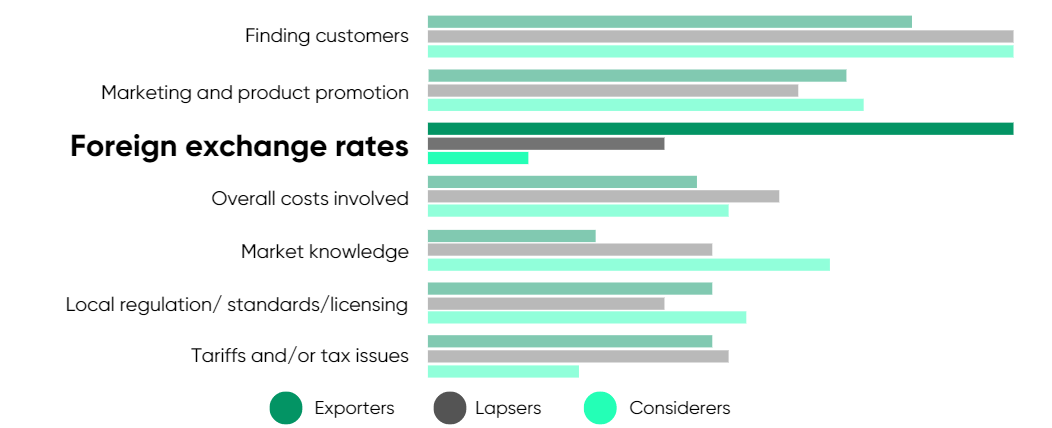

Of particular interest in the FSB survey on this slide is that those not exporting but considering exporting (the short small light green line) may be somewhat naïve in not considering currency risks to be important until they start exporting and then it jumps to become their #1 main challenge (the long dark green line).

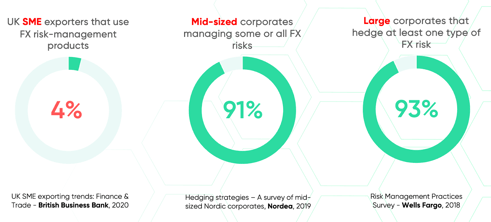

This is the current situation: only a very few [enlightened] small companies do anything to mitigate these risks. The others just bravely take it on the chin unnecessarily. The implications of this are that they need to hold larger cash reserves and that the true profitability of a piece of foreign business is almost impossible for them to decipher. Good business looks bad and vice versa.

Big companies simply do the opposite.

UNDERLYING PROFIT FROM FOREIGN BUSINESS

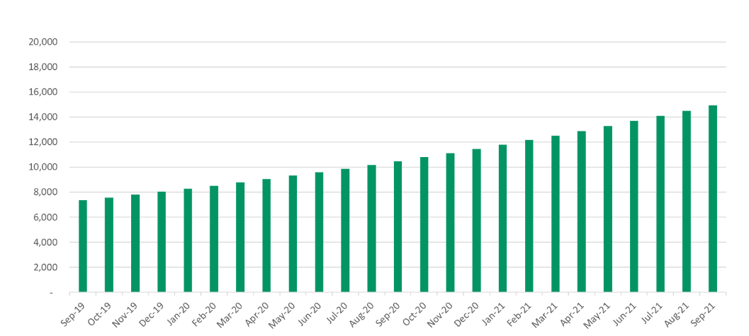

Foreign trade is hard and setting yourself up for it is time-consuming; finding reliable suppliers, customers, distributors, transportation costs and logistics providers all takes time and effort. So imagine you have set all of this up and you start a nice international business with what you think are growing profits. Look at that. You could show that to any investor on the planet and they would say; "I'll have some of that please".

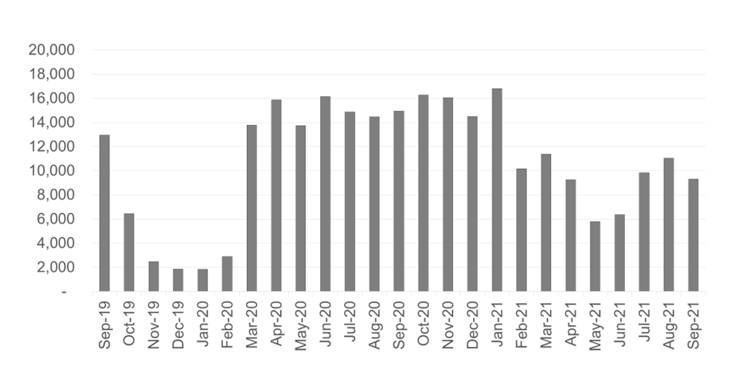

But what you actually end up with: the profits that actually come through your accounts look like this:

This is a real example and look what has happened here, particularly in the first 6 months of operation. Having toiled to set everything up, this company then fell into a ditch because they didn’t manage their financial risks. All that wasted work and opportunity.

READY, SET, GROW!

Bamboos can grow almost everywhere without needing expert care. UK SMEs can grow anywhere and spread prosperity with HedgeFlows.

HedgeFlows helps remove the financial risks and complexities of trading in foreign currencies, eliminates manual processes and errors and can help improve profitability. But don't take our word for it, you can read some successful stories from our own clients:

If you'd like to get in touch to ask us any doubts you may have, you can send us an email to info@hedgeflows.com or start a chat with any of our advisers.

May 3, 2023 3:09:42 PM