Lessons from working with ambitious global companies, big and small - by Alex Axentiev.

SIMPLIFYING INTERNATIONAL PAYMENTS

AVOID A CHESS MATE FROM CURRENCY RISKS

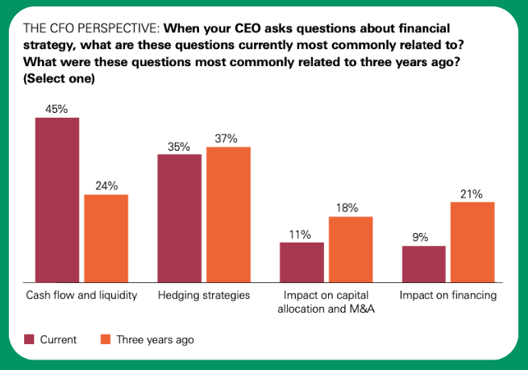

Cash flow, liquidity management and hedging have been increasing in importance for CFOs, and if you have a board or VC investors, you can expect the same questions as you grow.

CASE STUDY: MOOTEEFE'S TRANSFORMATION

To illustrate the benefits of modernising payment processes, let's look at the example of Moteefe, a fast growing e-commerce platform operating globally. Before adopting HedgeFlows, Moteefe faced manual, error-prone payment procedures involving multiple banks and lengthy reconciliations. By centralising their payment operations with HedgeFlows, Moteefe's finance team experienced significant time savings, reduced errors and streamlined processes. They could review and prepare payables, schedule payments in advance, automate currency conversions, and reconcile transactions seamlessly. The result was enhance efficiency, improved financial control, and increased accuracy in international payments.

DEVELOPING A CURRENCY RISK MANAGEMENT STRATEGY

CFOs must proactively address currency risk and develop a robust strategy aligned with the company's objectives. This includes

- Determining realistic budget rates

- Estimating potential impacts of FX uncertainty

- Establishing risk tolerance

- Creating a process to monitor and mitigate risks

Collaborating with a fintech partner like HedgeFlows can provide valuable guidance and technology-driven solutions to support effective risk management. By implementing a comprehensive strategy, companies can safeguard their financial performance, earn investor trust, and ensure long-term sustainability.

DEBUNKING HEDGING MYTHS

There are common misconceptions around hedging, such as believing that high-margin companies do not require hedging. However, even profitable organizations like Apple and Microsoft actively hedge their currency risks due to unique factors influencing their business models. Understanding the nuances of hedging strategies tailored to a company's specific circumstances in essential. With comprehensive visibility into forecasted cash flows and robust frameworks, companies can make informed hedging decisions that align with their risk tolerance, market conditions, and long-term objectives. By debunking these myths and embracing hedging as a proactive risk management tool, businesses can protect their profitability, mitigate potential losses, and navigate volatile currency markets with confidence.

International business operations come with inherent challenges, particularly in the realms of payments, currency risks and cash flow management. However, by leveraging modern fintech solutions, companies can streamline their operations, enhance financial visibility and optimise their global performance.

If you would like to learn more about HedgeFlows and how our platform can help you plan and manage your businesses' international growth get in touch!

Jun 22, 2023 11:33:04 AM