Imagine the world where hotels or airlines only allow you to buy their services when you're about to use them and room rates or ticket prices fluctuate all the time. Otherwise pleasant anticipation of your next holiday in Greece or Spain will most likely be ruined by the stress of not knowing how much this holiday may cost, seeing prices go up or down as you helplessly wait.

And even if you plan well and try to book your holiday when the offers are good - there is nothing you can do unless you want to go to Greece in February.

When it comes to international payments this is exactly what banks or other financial service providers offer to most SMEs. If you need to pay a foreign currency invoice, you have to wait until the payment day to find out what the exchange rate will be at the time and consequently how much this payment will cost in your home currency. That doesn't seem fair, does it?

THE BASICS of foreign exchange (fx) for businesses

As currencies can sometimes move several percent in a day, the value of invoices, orders and future payments in foreign currencies changes in terms of what they are worth in your home currency. These fluctuations generate currency exposures, costs and risks.

Usually, the buyer is obliged to pay the seller a pre-agreed number of days after being invoiced. This means that if your business trades in other currencies it will have to absorb exchange rate fluctuations from the moment when orders or invoices in foreign currency are booked until payments are made.

HOW PRE-BOOKING EXCHANGE RATES CAN HELP

HedgeFlows helps you pre-book your next currency exchange akin to booking your next holiday abroad. Whether you like the prices (exchange rates) at the moment or don’t feel comfortable waiting to find out the costs later, you can simply pre-book your current exchange rate for your future transfers by securing it with a small booking fee and a deposit. When you are ready to pay your currency invoice, you simply fund the transaction with HedgeFlows from your trusted bank account and instruct the transfer online.

How much can rates move?

Besides giving the comfort of knowing your costs in advance, HedgeFlows' solutions offer tips to make informed decisions - how current costs compare to the recent past and how much they could move in the future. It is the latter that is often important to know and was difficult to estimate without our solutions. The longer you have to wait before you pay your invoice more time there is for currency rates to potentially move away from the levels you could get today. Depending on the direction of the move this could mean good or bad news for one's business and what is good for an exporting business is bad for an importer.

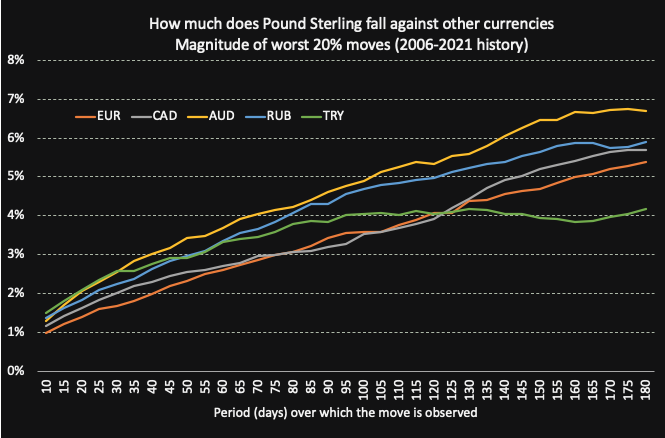

Importers or other businesses that need to pay foreign currencies invoices can potentially save by pre-booking early if their home currency weakens against the foreign currency they have to pay. Below is an example of historical data of how much Pound Sterling has fallen against some currencies over different periods in the past.

Conversely, businesses that are expecting foreign currency payments from their buyers would be better off if they pre-book rates and the foreign currency they are to collect weakens afterwards. Given the magnitude of falls for some emerging currencies, it may be important for companies to know this as they weight the cost of booking their currency conversions.

A FRESH APPROACH TO FOREIGN EXCHANGE (FX)

Planning ahead with certainty is many businesses' priority. In an open market where exchange rates fluctuate constantly due to political or economic events, it can be difficult to predict currency changes. That's why pre-booking your currencies is the best strategy to avoid unpredicted losses for your business.

With solutions like HedgeFlows you can keep more of your money (conversion fees as low as 0.25%) while saving time by making all your international payment runs using pre-booked guaranteed exchange rates.

If you'd like to find out more about the importance of FX management for businesses and how the HedgeFlows system works to automate all your international finance needs, get in touch.